Complete Guide to Industrial Slitting Lines: Types, Applications & Selection

Industrial metal processing operations face an ongoing challenge: transforming wide master coils into the precise strip widths required by downstream manufacturing. A slit line delivers the solution through high-speed rotary cutting systems that convert single coils into multiple narrower coils with minimal waste and maximum precision. Modern slitting lines achieve speeds up to 400 m/min while maintaining tolerances as tight as ±0.05mm, making them indispensable for automotive stamping, steel service centers, and appliance manufacturing. This comprehensive guide examines the classification systems, technical specifications, and financial considerations that determine optimal slitting line selection for your production environment.

Understanding the capacity ranges, material compatibility, and automation levels available enables production managers to match equipment investments to actual operational requirements. Whether processing thin-gauge aluminum for electronics or heavy structural steel for construction, the right slitting configuration maximizes material yield, reduces setup time, and delivers measurable ROI through labor savings and throughput improvements.

What is a Slitting Line and How Does It Work

A slitting line is precision industrial equipment engineered to transform wide metal coils into multiple parallel strips through synchronized cutting, tension control, and recoiling operations. The system processes coils at speeds ranging from 60 m/min for heavy-gauge structural steel to 400 m/min for thin aluminum and stainless steel, with each machine cycle converting a single master coil into 2-20 finished narrow coils depending on width specifications.

The process begins with a hydraulic decoiler featuring expanding mandrels that secure coils weighing 10 to 50 tons. Entry pinch rolls powered by servo motors grip the material and feed it through multi-roll levelers that eliminate coil set and cross-bow defects before cutting. The heart of the system consists of circular blade arrays—typically tungsten carbide or ceramic composite tooling—mounted on precision arbors with CNC-controlled positioning that enables width adjustments within 10 minutes versus 40 minutes for manual systems.

Critical to achieving ±0.1mm width tolerances is the multi-zone tension control subsystem. Load cells and dancer rolls continuously monitor and adjust strip tension across entry, slitting, and exit zones, preventing material elongation or compression that would compromise dimensional accuracy. Loop control mechanisms with optical sensors accommodate speed differentials between process stages, maintaining material stability during acceleration and deceleration cycles.

The fundamental distinction between slitting and cut-to-length (CTL) processing centers on output format. Slitting produces coiled strips ideal for continuous-feed stamping presses, roll forming mills, and tube welding operations, while CTL lines generate flat sheets of specific lengths for blanking and fabrication applications. This operational difference directly impacts equipment configuration, with slitting lines incorporating tension recoilers rather than the shear mechanisms and stacking systems found in CTL installations.

Types of Slitting Lines by Capacity

Slitting lines are classified by material thickness capacity, with each category optimized for distinct material properties, production volumes, and tolerance requirements. This classification framework guides equipment selection by aligning mechanical specifications with actual processing demands.

Light Gauge Systems (0.15-2.0mm)

Light gauge configurations process thin materials including aluminum alloys, copper, pre-painted steel, and stainless steel foils for electronics, packaging, and appliance applications. These systems feature precision blade assemblies with clearances measured in thousandths of millimeters to prevent edge distortion on materials as thin as 0.15mm. Entry and exit tensions typically range from 2-8 kg per millimeter of width, with servo-controlled adjustment maintaining consistency across varying material tempers.

Standard features include automated edge trimming systems that remove slit edge burrs without secondary processing, and rubber-coated guide rolls with 60-65 Shore A hardness ratings that prevent surface marking on pre-painted and polished materials. Production speeds reach 250-400 m/min for aluminum and copper, with quick-change arbor systems enabling material transitions within 15-20 minutes.

Medium Gauge Lines (1.0-6.0mm)

Medium gauge slitting lines represent the workhorse category for steel service centers, automotive component manufacturers, and HVAC duct fabricators. These systems balance processing speed with mechanical robustness, handling materials from cold-rolled steel to 304/316 stainless steel with yield strengths up to 550 MPa. Decoiler capacities typically span 20-35 tons with 508-610mm mandrel diameters to accommodate standard coil dimensions.

Blade systems utilize carbide-tipped tooling operating at 100-200 m/min, with gap adjustments controlled via HMI touchscreens that store width configurations for frequently processed jobs. Three-zone tension control with independent servo drives for decoiler, slitter section, and recoiler maintains strip flatness while processing material hardness variations within single coils. These lines commonly serve operations requiring frequent width changes, with semi-automated blade positioning reducing setup labor by 60-70% compared to manual adjustment systems.

Heavy Gauge Configurations (3.0-12.0mm)

Heavy gauge systems process structural steel grades, thick stainless alloys, and construction materials where cutting forces exceed light and medium gauge capacities by 3-5x. Reinforced frame construction and hydraulic clamping mechanisms withstand the mechanical stresses generated when slitting 980 MPa automotive steels or abrasion-resistant AR400/500 plate materials. Decoilers feature dual-cylinder expanding mandrels rated for 40-50 ton coils, with auxiliary support arms preventing coil telescoping during unwinding.

Blade assemblies employ premium tungsten carbide or ceramic composite inserts delivering 5,000-8,000 linear meters of cutting before replacement versus 1,500-2,500 meters for standard carbide on these demanding materials. Processing speeds range from 60-120 m/min depending on thickness, with four-zone tension control systems applying up to 25 kg/mm of strip tension to maintain flatness on high-strength grades. Heavy gauge lines commonly integrate in-line thickness gauging and width verification systems to document compliance with customer specifications.

Automation Integration Levels

Contemporary slitting lines span a spectrum from manual adjustment to Industry 4.0 connectivity. Manual systems require mechanical positioning of blade spacers and hand-wheel tension adjustment, suitable for job shops processing 2-5 orders daily with stable material specifications. Hydraulic semi-automatic configurations incorporate powered blade positioning and preset tension controls, reducing setup times to 20-25 minutes for service centers handling 8-15 width changes per shift.

Fully automated installations feature CNC blade positioning, recipe-driven setup from HMI systems, and AI-driven predictive maintenance monitoring vibration signatures and cutting force trends. These systems achieve 8-12 minute changeovers while collecting production data for SPC analysis and OEE tracking. Control system upgrades enable existing equipment to incorporate Industry 4.0 capabilities without complete line replacement.

Industrial Applications and Markets

Modern slitting line technology serves diverse manufacturing sectors where precision metal strips enable downstream production efficiency. Understanding application-specific requirements clarifies which equipment features deliver operational value versus marketing specifications.

Automotive Manufacturing demands width tolerances of ±0.1mm for body panel blanks, structural reinforcements, and trim components feeding automated stamping presses. Advanced high-strength steels (AHSS) with tensile strengths exceeding 980 MPa require specialized blade materials and tension profiles to prevent edge cracking during the slitting process. Production volumes in automotive tier-1 and tier-2 facilities often justify dedicated slitting lines optimized for specific material grades, with quick-change tooling packages enabling processing of multiple gauges within the same alloy family.

Steel Service Centers represent the highest-volume application segment, processing diverse material mixes including cold-rolled, hot-rolled, galvanized, and stainless steel grades. These operations prioritize setup efficiency and width flexibility, requiring systems capable of 15-25 width configurations per shift while maintaining throughput rates of 150-250 tons daily. Multi-zone tension control becomes critical when processing coils with variable mechanical properties, preventing strip breaks that generate 45-60 minutes of downtime for re-threading and quality verification.

Electronics and Appliance Manufacturing relies on precision thin-gauge strips for transformer cores, motor laminations, and appliance cabinets where electrical steel properties and surface quality directly impact product performance. Silicon steel slitting for transformer applications requires specialized blade geometry and minimal burr heights—typically under 0.02mm—to prevent core losses that reduce transformer efficiency. Material-specific processing parameters determine blade selection and tension profiles for these demanding applications.

Construction and Building Materials sectors consume heavy-gauge slit coils for window frames, steel doors, ceiling grid systems, and structural beams. Width accuracy requirements are less stringent than automotive (±0.127mm typically acceptable), but material handling becomes critical when processing 8-12mm thick coils weighing 35-50 tons. Systems serving this market incorporate reinforced recoiler mandrels and auxiliary coil support mechanisms to prevent edge damage during high-inertia acceleration and deceleration cycles.

Specialized Aerospace and Food Service Applications impose unique requirements beyond standard industrial slitting. Aerospace alloys like 7075-T6 and 2024-T3 aluminum demand certified processing environments with documented traceability and blade tool life records for quality management systems. Food-grade stainless steel (316L) processing for commercial kitchen equipment requires sanitary blade designs without crevices that could harbor contaminants, plus surface protection systems preventing cross-contamination from lubricants used on industrial-grade materials.

Requisitos de transformación específicos de los materiales

Successful slitting line operation extends beyond mechanical capacity to encompass metallurgical understanding of how different alloys respond to high-speed shearing forces and tension control.

Stainless Steel Processing Challenges

Austenitic stainless grades (304, 316) exhibit significant work hardening during cutting, with hardness increasing 40-60% in the heat-affected zone adjacent to slit edges. This phenomenon accelerates blade wear and increases cutting forces compared to carbon steel of equivalent thickness. Grade-specific parameters include reduced cutting speeds (80-120 m/min versus 150-200 m/min for carbon steel) and specialized blade coatings—titanium nitride or diamond-like carbon—that reduce friction and extend tool life by 2-3x.

Ferritic stainless grades (430, 409) generate different challenges, particularly magnetic attraction between strips and process equipment that can cause strip overlap during recoiling. Edge burr control becomes critical for food service applications where sharp edges pose contamination risks, requiring blade gap adjustments within 0.005-0.010mm and post-slit deburring on high-value coils.

Aluminum Alloy Considerations

Soft aluminum alloys (1100, 3003) tend to gum blade edges, building up adherent deposits that degrade cut quality and eventually cause blade fracture. Specialized coatings and increased blade clearances (0.10-0.15mm versus 0.05-0.08mm for steel) minimize this accumulation. Processing speeds for soft alloys typically reach 250-350 m/min, significantly faster than harder grades.

Aerospace-grade aluminum (7075-T6, 2024-T3) with yield strengths approaching 500 MPa requires premium blade materials—often ceramic composites—to maintain edge geometry through production runs. Cutting forces increase 3-4x compared to commercial alloys, necessitating reinforced arbor assemblies and increased drive motor capacity. Tension control becomes more critical as these harder alloys exhibit less elongation before fracture, requiring precise load cell feedback to prevent strip breaks.

High-Strength Automotive Steel Requirements

Advanced high-strength steels (AHSS) with tensile strengths exceeding 980 MPa—including dual-phase (DP), transformation-induced plasticity (TRIP), and martensitic grades—have transformed automotive lightweighting strategies while creating substantial slitting challenges. These materials generate cutting forces 4-6x higher than mild steel, accelerating blade wear to the point where tool life may drop to 1,500-2,500 linear meters versus 8,000-12,000 meters for cold-rolled steel.

Premium tungsten carbide blades with 10-12% cobalt binders deliver 3-5x extended service life on AHSS compared to standard carbide tooling, justifying their 2-3x higher initial cost through reduced changeover frequency and improved dimensional consistency. Processing speeds typically decrease to 80-120 m/min to manage heat generation and maintain edge quality specifications demanded by stamping operations.

Pre-Painted and Coated Material Protection

Color-coated steel and aluminum for building panels, appliance exteriors, and architectural applications require surface protection systems throughout the slitting process. Rubber-coated guide rolls with precisely controlled hardness (60-65 Shore A) prevent coating damage, while adjustable entry and exit tensions—typically 30-40% lower than bare metal—avoid coating cracking at bend radii.

Separator film systems automatically insert polyethylene or kraft paper between wound strips, preventing coating transfer between wraps that would create cosmetic defects requiring expensive rework. These materials command premium pricing ($200-400/ton markup versus bare steel), making scrap prevention through optimized slitting parameters directly impact profitability.

Criterios de selección de equipos

Systematic evaluation of slitting line specifications against operational requirements prevents costly mismatches between equipment capabilities and actual production demands.

Coil Specification Compatibility

Maximum width capacity represents the primary classification parameter, with standard configurations spanning 850mm, 1,350mm, 1,650mm, and 2,200mm. Production planning must account for edge trim requirements—typically 10-25mm per side—when matching equipment width to incoming coil dimensions. A 1,350mm line effectively processes 1,300mm usable width after trim removal, accommodating coil widths from 300mm to 1,350mm with optimal efficiency in the 600-1,200mm range.

Thickness range specifications indicate both minimum and maximum processing capabilities, but optimal performance typically occurs in the middle 60% of the stated range. A line rated for 0.3-12mm thickness delivers best results on 2-8mm materials, with thinner gauges potentially experiencing tension control challenges and thicker materials approaching mechanical load limits. Weight capacity determines coil handling capability, with 20-35 ton capacities serving most service center applications and 40-50 ton systems required for heavy structural steel operations.

Production Requirements Assessment

Target line speed directly impacts throughput, but realistic speed expectations must account for material properties and setup time. A 250 m/min rating applies to optimal conditions—clean entry edges, consistent material hardness, mid-range thickness. Actual production speeds often run 60-70% of maximum ratings when processing challenging materials or executing frequent width changes.

Setup frequency analysis reveals whether CNC blade positioning justifies its 30-40% cost premium over manual systems. Operations executing 15+ width changes per shift achieve payback within 12-18 months through labor savings (setup time reduction from 40 minutes to 10 minutes) and increased productive run time. Job shops with 3-5 daily setups may find hydraulic-assist manual positioning adequate, deferring automation investment until volume growth justifies the capital allocation.

Width tolerance demands determine whether ±0.127mm (standard), ±0.1mm (precision), or ±0.05mm (ultra-precision) capability is required. Automotive stamping applications typically mandate ±0.1mm or tighter to prevent feeding issues in progressive dies, while construction materials accept ±0.127mm tolerances. Achieving tighter tolerances requires more sophisticated blade mounting systems, precision arbors with minimal runout (under 0.02mm TIR), and enhanced tension control—features that increase equipment cost by 15-25%.

Technology Feature Evaluation

CNC blade positioning systems utilize servo motors and ball screw drives to position blade spacers with ±0.05mm repeatability, storing up to 200 width configurations in HMI memory for one-touch recall. Setup time reductions from 40 minutes (manual measurement and mechanical adjustment) to 8-12 minutes (automated positioning with verification) translate to 2-3 additional production hours daily on facilities executing 12-15 setups per shift. This productivity gain generates $120,000-180,000 annual value at typical service center labor and throughput rates.

Multi-zone tension control systems independently regulate decoiler, slitter section, and recoiler tensions through dedicated servo drives and load cell feedback. This sophistication prevents common defects including edge wave (insufficient tension at strip edges), center buckle (excessive center tension), and strip breaks (tension spikes during acceleration). Single-zone systems adequate for consistent materials and stable production runs cost 40-50% less but lack the adaptability required when processing diverse material mixes.

Automated blade change systems reduce tooling replacement time from 90-120 minutes (manual arbor disassembly and blade positioning) to 25-35 minutes through quick-release blade packs and indexed positioning. High-volume operations changing blades every 3-5 days achieve payback within 18-24 months through reduced labor and increased equipment utilization.

Blade System Technologies

Carbide-tipped blades serve as baseline tooling for cold-rolled steel, offering 3,000-5,000 linear meters of service life at material costs of $35-55 per blade. Tungsten carbide construction increases tool life to 8,000-12,000 meters on carbon steel and 3,000-5,000 meters on stainless grades, with blade costs of $85-120 offsetting the premium through extended replacement intervals.

Ceramic composite blades—utilizing aluminum oxide or silicon nitride matrices—deliver 12,000-18,000 meter life on high-strength automotive steels but command $200-300 per blade pricing. Cost-per-meter calculations reveal ceramic tooling reduces per-ton slitting costs by $0.15-0.25 on AHSS despite the initial price premium, justifying their deployment on dedicated automotive lines processing 500+ tons monthly.

HMI-controlled gap adjustment enables real-time blade clearance optimization without stopping production, accommodating thickness variations within coils that would otherwise generate quality defects. This capability proves particularly valuable when processing hot-rolled pickled and oiled (HRPO) steel exhibiting ±0.15mm thickness tolerance across coil length.

Automation Level Justification

Manual adjustment systems requiring mechanical blade positioning and hand-wheel tension control suit job shops processing stable material specifications with 2-5 orders daily. Initial equipment cost typically ranges $300,000-450,000 for medium gauge capacity, with minimal ongoing software or control system maintenance requirements.

Semi-automatic configurations incorporate hydraulic blade positioning, preset tension controls, and basic HMI interfaces for width storage, reducing setup times to 20-25 minutes. These systems serve service centers handling 8-15 width changes per shift, with equipment pricing in the $500,000-750,000 range representing a balanced investment between capability and cost.

Fully automated installations featuring CNC positioning, recipe-driven setup, and AI predictive maintenance monitoring deliver 8-12 minute changeovers while collecting production data for statistical process control. Equipment costs reach $850,000-1,200,000 for medium gauge systems, justified by high-volume operations (3,000+ tons monthly) where setup efficiency and data-driven quality management directly impact competitive positioning.

ROI Analysis and Investment Justification

Slitting line capital allocation decisions require comprehensive financial modeling that captures both direct cost savings and strategic operational benefits.

Rangos de inversión en equipos

Basic manual light-gauge systems (850mm width, 0.3-3.0mm capacity) enter the market at $300,000-400,000, suitable for job shops and contract processors handling stable material specifications. Medium gauge semi-automatic configurations (1,350mm width, 0.3-6.0mm capacity) with hydraulic positioning range $500,000-750,000, serving steel service centers requiring width flexibility without full CNC automation.

Heavy-gauge CNC systems (2,200mm width, 0.3-12.0mm capacity) with automated blade positioning, multi-zone servo tension control, and Industry 4.0 connectivity command $1,200,000-2,000,000 investments. These installations serve high-volume operations processing 3,000-5,000 tons monthly where setup efficiency, material yield optimization, and predictive maintenance justify premium automation capabilities.

Direct Financial Impact Quantification

Labor reduction represents the most tangible ROI component. Automated blade positioning reduces setup time from 40 minutes (manual) to 10 minutes (CNC), eliminating 30 minutes per changeover. At 12 setups per shift and $65/hour loaded labor rates, this generates $195/shift savings or $48,750 annually (250 working days). Operations with 2-3 operators per shift reduce headcount by 1-2 positions through automation, yielding $150,000-300,000 annual labor cost avoidance.

Throughput increases of 30-50% result from faster setup transitions and optimized processing speeds. A service center processing 2,000 tons monthly at $200/ton contribution margin gains $120,000-200,000 annual incremental profit by increasing capacity to 2,600-3,000 tons without facility expansion or additional equipment acquisition.

Material waste reduction impacts profitability directly in high-volume environments. Edge trim optimization through CNC blade positioning reduces scrap from 4.5% to 3.0%, saving 1.5% of raw material costs. Processing $10 million annually in coil value generates $150,000 annual material savings—a benefit often overlooked in traditional ROI calculations focused solely on labor and throughput.

ROI Modeling Example

A mid-sized steel service center evaluates a $500,000 semi-automated slitting line upgrade replacing 15-year-old manual equipment. Financial modeling projects:

- Labor savings: $180,000 annually (1.5 operators eliminated, reduced overtime)

- Throughput gain: $140,000 annually (700 incremental tons at $200/ton margin)

- Material yield improvement: $110,000 annually (1.1% scrap reduction on $10M material flow)

- Energy efficiency: $25,000 annually (servo drives versus hydraulic systems)

- Total annual benefit: $455,000

Against $50,000 annual operating costs (maintenance, blade tooling, utilities), net annual benefit reaches $405,000. Simple payback calculates to 1.23 years with 81% first-year ROI, compelling economics for equipment with 15-20 year service life.

Consideraciones sobre eficiencia energética

Modern servo-driven tension control systems reduce electrical consumption 20-25% compared to hydraulic systems maintaining constant pump pressure. A medium-gauge line operating 5,000 hours annually at 150 kW average load consumes 750,000 kWh. Efficiency improvements of 22% save 165,000 kWh annually, worth $16,500-23,100 at industrial electricity rates ($0.10-0.14/kWh). Over a 10-year equipment service life, cumulative energy savings reach $165,000-231,000—sufficient to justify servo technology even absent other automation benefits.

Variable frequency drives (VFDs) on process motors enable speed optimization matching material specifications, further reducing energy waste during setup transitions and material changes. Regenerative braking systems capture deceleration energy for return to facility electrical systems, adding 3-5% efficiency gains on high-inertia decoiler and recoiler operations.

Strategic Value Quantification

Beyond direct financial metrics, slitting line capabilities enable strategic positioning difficult to capture in traditional ROI calculations. Faster delivery cycles improve customer satisfaction and retention—particularly valuable in service center markets where lead time often determines order allocation among competing suppliers. The ability to process specialty grades (titanium, Inconel, electrical steel) opens margin-rich market segments unavailable to competitors with limited processing capabilities.

Reduced work-in-process inventory from faster setup transitions improves cash flow and reduces floor space requirements. Coils processed within 24-48 hours of receipt versus 7-10 days for manual systems reduce inventory carrying costs by $50,000-100,000 annually while freeing 2,000-3,000 square feet for revenue-generating activities.

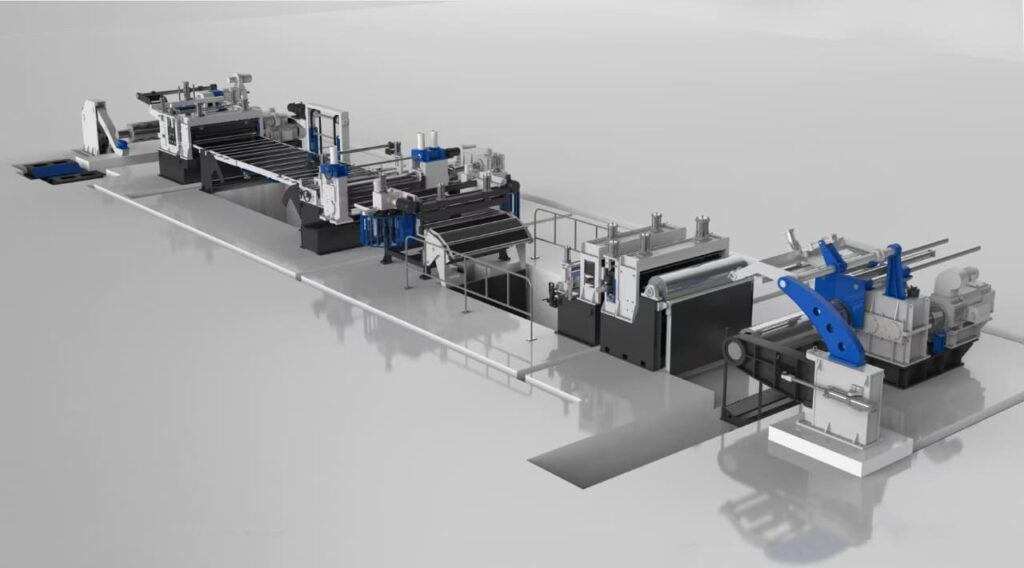

MaxDo MD Series Configurations

MaxDo’s MD series slitting lines deliver engineered solutions spanning light to heavy-gauge applications through standardized platforms with extensive customization options.

MD-850 Compact System

En MD-850 processes coils from 300-820mm width across thickness ranges of 0.3-12mm depending on material hardness and mechanical properties. Light gauge configurations (0.3-3.0mm) achieve 60 m/min processing speeds suitable for stainless steel and aluminum, while heavy gauge capability (4-12mm) serves structural steel applications at 40-50 m/min.

Decoiler capacity spans 10-35 tons with hydraulic expanding mandrels accommodating 508-610mm inner diameter coils. The 93 kW total power consumption positions this system for facilities with standard 480V three-phase electrical service without requiring utility infrastructure upgrades. Compact footprint (approximately 25-28 meters length) fits existing production floors without extensive facility modifications.

This configuration serves job shops, automotive component manufacturers processing door beams and structural reinforcements, and appliance manufacturers requiring precision strips for cabinet panels and internal components. Quick-change blade arbors enable material transitions between stainless steel and carbon steel within 25-30 minutes, supporting diverse product mixes without dedicated processing lines.

MD-1350 Service Center Workhorse

The MD-1350 extends width capacity to 1,350mm, accommodating the broader coil dimensions prevalent in steel service center operations. Thickness capability matches the MD-850 (0.3-12mm across multiple ranges), with processing speeds reaching 80 m/min on optimized materials. The 136 kW power requirement reflects increased motor capacity for wider strips and higher tension forces.

Standard features include semi-automatic blade positioning with hydraulic assist, three-zone tension control with load cell feedback, and HMI storage for 100+ width configurations. Decoiler capacity reaches 35 tons with optional 50-ton upgrades for facilities processing primarily heavy-gauge structural grades.

This system targets steel service centers serving construction, tube mill, and roll forming markets where width flexibility and setup efficiency directly impact competitive positioning. The width range accommodates 80% of service center product specifications, reducing the need for multiple dedicated lines while maintaining throughput efficiency across diverse order mixes.

MD-2200 Heavy-Duty Platform

The MD-2200 represents MaxDo’s flagship system for high-volume structural steel processing, with 2,150mm width capacity handling the master coils supplied by integrated steel mills. Power consumption reaches 422.5 kW reflecting reinforced drive systems, heavy-duty blade arbors, and increased recoiler capacity for large-diameter finished coils.

Reinforced frame construction withstands the cutting forces generated when processing 8-12mm thick high-strength grades, while precision ground ways maintain blade positioning accuracy despite mechanical loads exceeding medium-gauge systems by 3-4x. Standard configurations include automated loop control with accumulator pits, enabling continuous operation during recoiler mandrel changes that would otherwise halt production.

This platform serves steel service centers processing 3,000-5,000 tons monthly, integrated steel producers operating downstream conversion facilities, and specialized processors serving infrastructure and construction markets demanding rapid turnaround on large-volume orders.

Standard Feature Set

All MD series slitting lines incorporate turret-mounted carbide blade systems enabling rapid tooling changes without complete arbor disassembly. HMI-controlled gap adjustment provides real-time blade clearance optimization responding to thickness variations within coils, while integrated edge trimmers remove slit edge burrs without secondary processing.

Multi-zone tension control with dancer roll feedback maintains strip flatness across material hardness variations, preventing edge wave and center buckle defects that generate customer rejections. Precision arbors with under 0.02mm total indicator runout (TIR) deliver the geometric accuracy required for ±0.1mm width tolerances demanded by automotive stamping and precision appliance applications.

Servo-driven entry pinch rolls provide positive material feeding independent of coil diameter, maintaining consistent processing speeds throughout coil unwinding. Emergency stop systems with regenerative braking prevent strip damage during unplanned shutdowns, minimizing scrap generation and reducing restart time to 3-5 minutes.

Customization and Upgrade Options

Surface protection systems incorporate polyethylene separator film insertion for pre-painted and polished materials, preventing coating damage and eliminating manual interleaving labor. Automated loop accumulators extend to 15-20 meters, enabling processing speed optimization independent of recoiler capacity constraints.

Control system enhancements provide Industry 4.0 connectivity through Ethernet/IP or Profinet protocols, enabling integration with facility MES systems for real-time production monitoring and OEE tracking. Predictive maintenance modules monitor vibration signatures, bearing temperatures, and cutting force trends, generating maintenance alerts 7-14 days before component failures occur.

Optional thickness gauging systems verify incoming coil specifications and detect thickness variations requiring blade gap adjustments, while width verification lasers document finished strip dimensions for quality management systems. These measurement systems prove particularly valuable when processing certified materials for aerospace and medical device applications where dimensional traceability requirements mandate documented verification at each process stage.

Conclusión

Slitting line selection demands systematic evaluation of capacity requirements, material specifications, and financial performance metrics that extend beyond initial equipment cost. Understanding the distinctions between light, medium, and heavy-gauge systems—and how material properties influence processing parameters—enables production managers to match equipment capabilities to actual operational demands. The progression from manual adjustment to fully automated CNC systems reflects not just technological sophistication but fundamental differences in how setup efficiency, quality consistency, and data integration impact competitive positioning.

MaxDo’s MD series delivers engineered solutions across this spectrum, from the compact MD-850 serving job shops and automotive component manufacturers to the heavy-duty MD-2200 processing structural steel for infrastructure markets. Standardized platforms with extensive customization options enable precise alignment between equipment specifications and production requirements, while proven reliability across 500+ global installations demonstrates field-validated performance.

Comprehensive ROI analysis capturing labor savings, throughput gains, material yield improvements, and energy efficiency reveals that modern slitting lines typically achieve payback within 18-36 months despite substantial capital requirements. Strategic benefits including faster delivery cycles, specialty material capabilities, and reduced inventory carrying costs reinforce the financial case for equipment investment in operations where metal coil processing forms a core competency.

Contact MaxDo’s engineering team to discuss how MD series slitting line configurations can optimize your metal processing operations with precision equipment delivering 96%+ material yield and ±0.1mm dimensional accuracy across diverse material grades and production volumes.