Metal Slitting Line Equipment Guide 2026: ROI Analysis, Automation & Technology Selection for Manufacturers

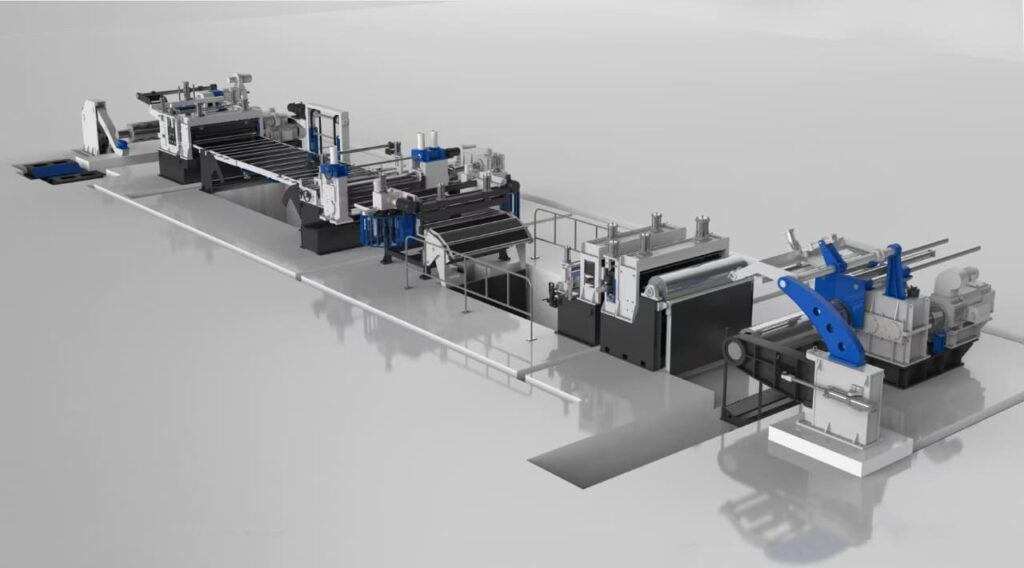

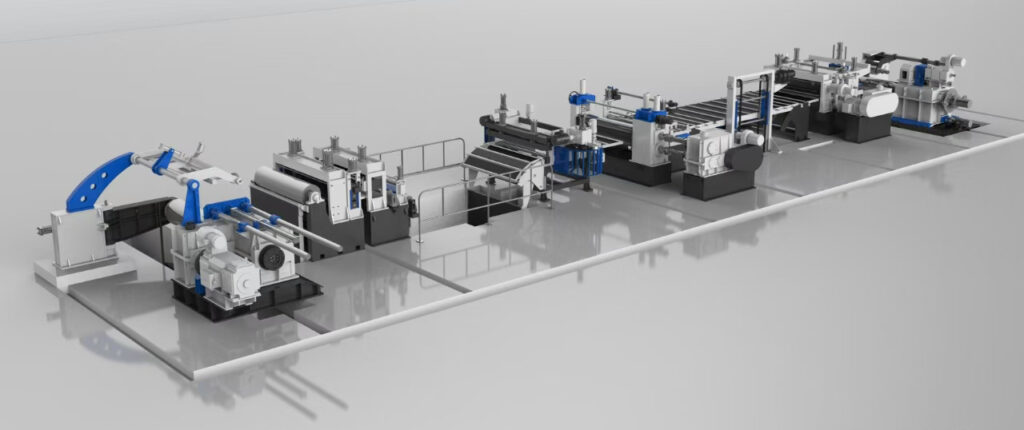

This guide dives deep into the slitting line process, key components, applications, and why advanced models from leaders like MaxDo Machinery are reshaping industrial workflows.

Walk through any metal service center that’s been operating since the 1990s and you’ll likely find a slitting line that still works—technically. The machine unwinds coils, knives cut strips, recoilers wind them back up. But watch the operator spend forty minutes setting up knife spacing with feeler gauges and manual adjustments, then measure the first strips to find they’re 0.3 mm outside specification, and you’ll understand why modern servo-controlled systems cost three times as much.

This comprehensive guide addresses the critical decision facing manufacturers today: selecting the right metal slitting line equipment for your production requirements. Whether you’re a job shop processing light-gauge materials, a steel service center handling diverse product mixes, or a large fabricator processing structural grades, the equipment you choose will directly impact your material yield, operational efficiency, and return on investment. MaxDo, an ISO 9001-certified manufacturer with over 20 years of R&D experience and 500+ installations across 30+ countries, has helped manufacturers worldwide optimize their coil slitting operations with the MD series of precision metal slitting lines—delivering 96%+ material yield with ±0.1mm accuracy.

This guide covers the essential technical foundations of metal slitting line equipment, explores advanced automation technologies, provides actionable ROI analysis frameworks, and guides you through equipment selection for your specific production workflow.

Understanding Metal Slitting Lines: Process Fundamentals vs. Cut-to-Length Systems

Metal slitting lines transform wide coils into multiple narrow strips through rotary knife systems that maintain dimensional control while running at speeds up to 400 meters per minute. This continuous-feed approach serves fundamentally different applications than cut-to-length operations—a distinction that prevents wasting capital on equipment that doesn’t match your production workflow.

Core Process Mechanics: From Master Coil to Slit Strips

The metal slitting process begins with the master coil mounting on a hydraulic decoiler with expanding mandrels that grip inner diameters from 508 to 610 mm. Controlled unwinding tension prevents strip wander and edge damage that create downstream handling problems. Entry pinch rolls guide material into the slitter head where circular blades arranged across the width execute parallel cuts. This engineered precision is why metal slitting lines represent a significant capital investment—the mechanical sophistication required to maintain consistent strip quality at high speeds demands precision manufacturing.

After cutting, the slit strips pass through tension control zones before recoiling. Each stage in this coil slitting machine process requires coordination to produce salable coils rather than scrap material requiring reworking. The metal slitting process integrates multiple precision systems working in concert: decoiler tension control, slitter head blade positioning, strip tension management, and recoiler speed coordination.

Slitting vs. CTL: Application Decision Matrix

Understanding when to choose slitting versus cut-to-length (CTL) processing is fundamental to equipment selection:

| Processing Type | Output Format | Typical Applications | Downstream Equipment | When to Choose |

|---|---|---|---|---|

| Metal Slitting Lines | Coiled strips (continuous feed) | Tube mills, roll forming lines, automotive components, appliance manufacturing | Equipment requiring continuous material feed | High-volume continuous processing, frequent width changes, material-specific tolerance needs |

| Cut-to-Length Systems | Flat sheets (specific lengths) | Construction framing, structural components, blanking operations | Press lines, blanking equipment, stacking systems | Discrete length requirements, construction industry, short-run production |

The core distinction: slitting delivers coiled strips for manufacturing processes that need continuous material feed, while CTL produces flat sheets of specific lengths for discrete manufacturing or construction applications. MaxDo’s dual product strategy serves both markets, allowing manufacturers to choose the solution that matches their downstream processing requirements.

Read our detailed comparison: Cut-to-Length Metal Processing vs. Metal Slitting

Advanced Tension Control Systems: Multi-Zone Technology & Strip Quality Management

Tension control between slitting and recoiling determines whether you produce salable coils or scrap that needs reworking. This is where modern servo-controlled slitting systems differentiate themselves from legacy hydraulic equipment.

Strip tension that’s too high stretches material and affects final width. Too low and lighter gauge strips buckle while heavier stock develops edge wave that won’t feed cleanly through downstream equipment. The cost of getting tension control wrong manifests as edge quality issues that generate customer complaints and returned orders—expenses that compound across production runs measured in thousands of feet of material.

MaxDo’s Multi-Zone Tension Architecture: Independent Strip Control

MaxDo’s multi-zone tension control systems (standard on MD-1350 and MD-2200) treat each slit strip independently, crucial when processing materials with varying thickness across the width. A single-zone system averages tension across all strips, which works when material is uniform but creates problems with thickness variation above 0.05 mm.

Modern systems use load cells, dancer rolls, and closed-loop servo feedback to maintain stable tension regardless of coil diameter changes during unwinding. Loop control systems between processing sections use optical sensors to monitor material slack, adjusting recoiler torque to maintain optimal strip tension. Without this feedback control, speed changes during knife engagement cause tension spikes that mark soft materials or stretch thin gauges beyond tolerance.

Independent zone control costs more upfront but prevents the edge quality issues that generate customer complaints and returned orders—costs that accumulate over equipment life and often exceed the initial investment difference within the first two years of operation.

Servo Feedback vs. Hydraulic Systems: Performance Comparison

The performance gap between servo-driven tension control and older hydraulic systems is significant:

| Control Type | Response Time | Setup Time | Tolerance Consistency | Energy Efficiency |

|---|---|---|---|---|

| Servo-Driven Feedback | <100ms | <10 minutes | ±0.05mm | 20-25% lower consumption |

| Hydraulic Manual Adjustment | 2-5 seconds (operator dependent) | 40+ minutes | ±0.3mm | Baseline |

The servo automation eliminates constant operator adjustment that older hydraulic systems required, reducing labor costs while improving consistency. This is where tension control slitting transitions from operator skill-dependent to system-guaranteed quality.

Explore setup time optimization strategies in our specialized guide

CNC Blade Setup & Precision Width Tolerance: Achieving ±0.127mm Accuracy

Achieving width tolerance within ±0.127 mm requires knife positioning accuracy measured in thousandths of an inch. Spacers between blades determine strip width, and misalignment of 0.05 mm multiplies across multiple knife pairs, potentially putting strips outside specification before the first cut.

Laser-Guided Positioning: Setup Time & First-Piece Accuracy

MaxDo’s CNC slitter heads use laser-guided positioning that eliminates manual measurement errors and cuts setup time from 40 minutes to under 10 minutes compared to mechanical systems. This isn’t merely a convenience—it directly impacts scrap rates and material utilization. Laser guidance systems reduce waste by 8 percent through improved dimensional control compared to manual setup methods.

CNC-controlled knife spacing follows digital instructions loaded from production scheduling systems, improving first-piece accuracy and reducing material waste from setup adjustments. The automation eliminates setup errors that waste operator time and generate scrap during initial setup cuts.

Blade Material Selection by Steel Grade

Blade wear patterns affect cutting forces and edge quality over production runs measured in miles of processed material. High-strength steel generates 50 percent higher cutting forces than mild steel, accelerating wear rates and requiring more frequent knife changes to maintain edge quality.

Hard contaminants—sand, metal chips, residue from coated materials—adhere to blade surfaces and increase cutting resistance, further accelerating the wear process. Regular cleaning and lubrication extend blade life by 20 percent compared to neglected maintenance. Accumulated debris increases friction coefficient and generates heat that degrades blade material properties.

The specific lubricant depends on material being processed—what works for cold-rolled steel may not suit stainless or aluminum alloys. Proper lubrication during cutting reduces surface temperature and wear rate, directly impacting blade service life and equipment cost-per-ton processed.

Predictive Blade Wear Monitoring

Advanced slitting line equipment now incorporates force monitoring on slitter heads that flags blade wear before edge quality degrades enough to generate customer complaints about dimensional variation or burr problems. This shift from reactive maintenance (replacing blades after quality issues appear) to predictive maintenance (replacing blades before problems occur) significantly reduces scrap generation and improves customer satisfaction.

Blade inspection schedules need to match production volume and material characteristics. High-usage environments processing abrasive materials require daily checks for micro-cracks or chips. Moderate-use operations can extend inspection intervals to weekly without significant risk. The key is catching edge degradation before it affects strip quality enough to generate customer complaints—because by then you’ve already produced potentially thousands of feet of marginal material.

Learn more about precision width tolerance control in our technical deep-dive

Material-Specific Processing: Stainless Steel, Aluminum & High-Strength Automotive Grades

The metal slitting process adapts to different material properties, but not all coil slitting machines handle every material equally well. Understanding material-specific requirements prevents expensive equipment mismatches.

Stainless Steel Slitting: Grade-Specific Parameters

Stainless steel work hardens during slitting, affecting knife life and edge quality in ways that carbon steel doesn’t. Blade materials and cutting speeds need adjustment for different grades—austenitic stainless requires different parameters than ferritic or duplex grades.

| Material Grade | Blade Type | Cutting Speed | Lubrication Type | Setup Complexity |

|---|---|---|---|---|

| 304 Stainless (Austenitic) | Carbide | 180-220 m/min | Oil-based coolant | Medium |

| 316L Food Service | Premium carbide | 150-180 m/min | Food-grade coolant | High |

| Ferritic Stainless | High-speed steel | 200-250 m/min | Light oil | Low-Medium |

| Duplex Stainless | Tungsten carbide | 120-150 m/min | Heavy-duty coolant | High |

Operations processing 316L for food service applications can’t tolerate edge burrs that might pass on structural applications where the material gets welded or formed in ways that hide minor edge defects. The tolerance standards differ dramatically based on downstream use.

Aluminum Processing: Edge Quality Management

Aluminum alloys gum cutting edges, requiring specialized blade coatings and more aggressive lubrication than steel processing. Softer grades like 1100 or 3003 may show edge distortion from cutting forces, requiring lighter knife overlap and reduced line speed to maintain quality. Harder aerospace alloys like 7075 or 2024 generate higher cutting forces that accelerate blade wear, making them more expensive to process on a per-foot basis.

High-Strength Steel: Premium Blade ROI Analysis

High-strength automotive grades above 980 MPa tensile strength create cutting forces that traditional blade materials can’t withstand for production runs. Premium tungsten carbide or ceramic composite blades cost significantly more—often 300-400% more than standard carbide—but deliver 3 to 5 times the service life when processing advanced high-strength steels.

The blade cost increase looks expensive until you calculate downtime and lost production from frequent knife changes on conventional tooling. A single unplanned blade failure that idles your line for emergency replacement, sourcing parts, and tool changes can cost $5,000-$15,000 in lost throughput. Over a year of processing high-strength materials, premium blade investment pays for itself multiple times over.

Pre-painted and coated materials need gentle handling to prevent surface damage. Rubber-coated guide rolls and optimized tension control protect finishes that would show marks from standard steel contact surfaces. The material cost difference between prime and rejected pre-painted steel makes surface protection equipment pay for itself quickly when processing high-value coated products.

Industry 4.0 Integration: Automated Systems & Predictive Maintenance Technology

The slitting machine market reached $525.9 million in 2024 with projected growth driven by automated high-speed systems and Industry 4.0 technology integration. This market expansion reflects manufacturers’ recognition that slitting line automation delivers measurable ROI through reduced downtime, improved quality, and optimized maintenance.

AI-Driven Predictive Maintenance: Downtime & Cost Reduction

MaxDo’s Industry 4.0-ready slitting lines integrate AI-powered predictive maintenance that cuts unplanned downtime by 50 percent and lowers repair costs 30 percent through monitoring that catches problems before failures occur.

Bearing vibration analysis detects wear patterns weeks before catastrophic failure that would idle equipment for days waiting on replacement parts and repair technicians. Hydraulic pressure sensors identify seal leaks while they’re still minor, preventing the sudden failures that dump oil across the floor and shut down production until cleanup and repair complete. Force monitoring on slitter heads flags blade wear before edge quality degrades enough to generate customer complaints about dimensional variation or burr problems.

The data streams feed maintenance scheduling systems that optimize service intervals based on actual wear rather than arbitrary calendar schedules. This transition from calendar-based maintenance to condition-based maintenance aligns maintenance activities with actual equipment needs, reducing unnecessary maintenance while preventing failures.

Automated Setup & Material Flow Control

Automated blade positioning eliminates setup errors that waste operator time and generate scrap during initial setup cuts. CNC-controlled knife spacing follows digital instructions loaded from production scheduling systems, improving first-piece accuracy and reducing material waste from setup adjustments. For operations running multiple width changes per day, this automation eliminates the setup time variability that creates bottlenecks and reduces throughput predictability.

Integrated Processing Lines: End-to-End Automation

Integration with upstream coil handling and downstream packaging systems creates complete processing lines where material flows continuously without intermediate handling. Coordinated control optimizes throughput and minimizes work-in-process inventory that ties up working capital. A well-integrated line processes master coils into finished strip bundles with minimal operator intervention beyond loading raw material and removing finished product.

This full-line integration represents the evolution of automated slitting systems from standalone equipment to coordinated production solutions. The throughput improvement from eliminating transfer delays between loosely-coupled equipment often exceeds 15-20 percent.

ROI Analysis & Investment Payback Calculator: Equipment Selection Framework

Equipment pricing ranges from $300,000 for basic manually-adjusted slitters handling light gauge material up to $2 million for fully automated heavy-gauge lines with CNC knife positioning, automated scrap removal, and integrated quality monitoring. The investment decision requires rigorous ROI analysis that accounts for both direct financial gains and strategic benefits that affect competitive positioning.

Direct Financial Gains: Labor, Throughput & Material Savings

MaxDo’s ROI calculation framework reveals how automated slitting lines deliver quantifiable returns through three primary channels:

Labor Reduction: Automated systems eliminate 2 to 3 operators per shift compared to manual operations, generating annual labor savings of $150,000 to $300,000 in high-wage markets. Modern servo-controlled equipment requires monitoring rather than constant adjustment, fundamentally reducing labor requirements.

Throughput Increases: 30 to 50 percent capacity improvement enables handling larger orders or shortening delivery cycles, improving customer satisfaction in ways that win repeat business. The ability to reduce delivery times from 6 weeks to 3 weeks often translates to premium pricing power in competitive markets.

Material Utilization: Precision slitting reduces edge trim waste and maximizes yield from specialty grades like stainless or coated steel where material cost dominates processing economics. A 5 percent improvement in material utilization on $2 million annual material purchases saves $100,000 per year—savings that compound over equipment life.

Payback Period Calculator: Automation Level vs. Production Volume

The standard ROI formula—[(Annual Benefit – Annual Cost) / Total Investment] × 100—provides the percentage return. A $500,000 slitting line generating $200,000 annual savings with $50,000 operating costs delivers 30 percent ROI and pays back in 3.3 years. Most manufacturers see payback within 24 to 42 months depending on production volume and automation level.

| Investment Level | Annual Labor Savings | Material Savings (5% improvement) | Operating Costs | Total Annual Benefit | Payback Period |

|---|---|---|---|---|---|

| $300,000 (Basic) | $80,000 | $40,000 | $25,000 | $95,000 | 3.2 years |

| $500,000 (Mid-Range) | $150,000 | $100,000 | $40,000 | $210,000 | 2.4 years |

| $1,000,000 (Advanced) | $250,000 | $150,000 | $60,000 | $340,000 | 2.9 years |

| $2,000,000 (Full Automation) | $300,000 | $200,000 | $100,000 | $400,000 | 5.0 years |

Note: Figures represent typical scenarios. Contact MaxDo for customized ROI analysis based on your specific production volume and material mix.

Energy Efficiency ROI: Servo vs. Hydraulic Systems

Energy efficiency on modern servo-driven lines cuts consumption 20 to 25 percent compared to older hydraulic systems. This advantage grows larger in regions with high electricity costs and on operations running multiple shifts. Cumulative energy savings over 10-year equipment life can reach six figures on high-volume lines processing thousands of tons annually.

For a manufacturer running two shifts (16 hours/day) processing 50 tons/day, the annual electricity cost difference between servo and hydraulic systems can exceed $30,000-$50,000 depending on regional rates. This ongoing operational savings often receive insufficient consideration in initial equipment evaluation but substantially impacts true cost of ownership.

Total Cost of Ownership (TCO): Beyond Initial Investment

True equipment evaluation requires considering maintenance costs, blade replacement frequency, operator training, and downtime costs over the equipment’s operational life. A lower-cost slitting line offering that requires higher maintenance spending, more frequent blade changes, and generates more quality issues may cost 40-60% more over 10 years than a higher-initial-cost system with superior reliability.

MaxDo MD Series Equipment Comparison: Selecting the Right Capacity Configuration

MaxDo’s MD series metal slitting line equipment spans entry-level to heavy-duty industrial applications, with models designed for job shops, service centers, and large-scale fabricators. Each configuration delivers the precision and reliability MaxDo is known for—96%+ material yield with ±0.1mm accuracy—while matching different production requirements and budgets.

MD-850: Entry-Level Precision for Job Shops & Mid-Volume Production

MaxDo’s MD-850 slitting line delivers precision processing for manufacturers requiring 20-820mm width capacity and 0.3-12mm thickness handling. Processing material at speeds up to 250 meters per minute, the MD-850 reaches 35-ton coil weight capacity with 138.5 kW total installed power.

This MD-850 slitting line configuration is sized for job shops and mid-volume manufacturers serving automotive and appliance markets. Hydraulic mandrel expansion accommodates standard coil inner diameters with servo tension control that maintains strip quality across varying material grades. The entry-level positioning doesn’t compromise on core technology—servo tension control, HMI interface, and precision blade positioning come standard.

Ideal Applications: Light to medium-gauge processing, frequent material changes, job shop environments with diverse customer requirements, operations processing under 50 tons/week.

MD-1350: Versatile Configuration for Service Centers

MaxDo’s MD-1350 extends width capability to 1,300mm while maintaining the same thickness range and line speed as the MD-850. Increased installed power of 318.5 kW supports the larger slitter head and additional recoiling stations needed for wider material processing. The 1350mm slitting line configuration suits service centers handling diverse product mix with frequent width changes where setup efficiency matters as much as maximum throughput.

The MD-1350 represents the sweet spot for most steel service centers and mid-volume coil processors. The 1350mm slitting line supply from MaxDo includes turret-mounted carbide blade systems with HMI-controlled gap adjustment, integrated edge trimmers with dedicated scrap winders, and multi-zone tension control with dancer feedback—enabling both high-precision processing and rapid setup between jobs.

Ideal Applications: Service center operations, frequent product mix changes, medium to heavy-gauge processing, operations processing 50-150 tons/week, applications requiring both precision and speed.

MD-2200: Heavy-Duty Processing for Structural & Construction Materials

MaxDo’s MD-2200 configuration processes widths up to 2,150mm across the full thickness range at 250 meters per minute. Total power reaches 422.5 kW to drive the larger equipment and maintain tension control across wide strips that generate higher forces. This MD-2200 slitting equipment targets steel service centers and large fabricators processing structural grades and construction materials where width capacity opens markets that smaller equipment can’t serve.

The MD-2200 is built for volume operations. Larger coil capacity, higher power delivery, and robust mechanical design support processing of high-strength materials and abrasive coatings that would accelerate wear on lighter-duty equipment. The investment in MD-2200 specifications is justified for operations processing 200+ tons/week or requiring the widest capacity range.

Ideal Applications: Large steel service centers, structural steel processing, construction material suppliers, heavy coatings (e-coat, paint, adhesive-backed), high-volume operations processing 200+ tons/week.

Custom Light Gauge Solutions: Specialized Material Handling

Beyond the standard MD series, MaxDo provides custom light gauge slitting machine configurations for processors requiring specialized handling of thin-gauge materials. Custom light gauge slitting machines feature precision decoiler design, reduced cutting forces, and gentle material guidance systems optimized for materials under 0.5mm thickness.

Applications include electrical lamination stock, precision foil processing, specialty composite materials, and specialty alloys requiring delicate handling to maintain surface finish. Customization for light gauge slitting extends MaxDo’s range beyond standard specifications, serving niche applications where standard equipment is either over-engineered (and expensive) or under-capable.

Equipment Comparison Matrix

| Specification | MD-850 | MD-1350 | MD-2200 |

|---|---|---|---|

| Width Range | 20-820mm | 20-1,300mm | 20-2,150mm |

| Thickness Range | 0.3-12mm | 0.3-12mm | 0.3-12mm |

| Line Speed | 250 m/min | 250 m/min | 250 m/min |

| Coil Weight Capacity | 35 tons | 40 tons | 50 tons |

| Installed Power | 138.5 kW | 318.5 kW | 422.5 kW |

| Typical Annual Throughput | 50-75 tons | 100-150 tons | 200+ tons |

| Primary Target Market | Job shops, small manufacturers | Service centers, mid-volume producers | Large service centers, fabricators |

| Material Yield | 96%+ | 96%+ | 96%+ |

| Accuracy | ±0.1mm | ±0.1mm | ±0.1mm |

All configurations include standard features: turret-mounted carbide blade systems, HMI-controlled gap adjustment, integrated edge trimmers, multi-zone tension control, and dancer feedback. Optional upgrades include surface protection systems and automated loop accumulators for specialized material handling without requiring custom engineering that extends delivery time and inflates costs.

Equipment Selection Decision Framework: Matching Capacity to Production Requirements

Selecting the right metal slitting line equipment requires systematic evaluation beyond simply choosing the lowest-priced option or highest-spec system. The optimal choice aligns equipment capacity, automation level, and features with your specific production requirements.

Production Volume & Width Range Requirements Analysis

Begin with two fundamental questions: What’s your annual processing volume in tons, and what’s the range of coil widths you need to handle?

| Annual Processing Volume | Typical Equipment Match | Reasoning |

|---|---|---|

| <50 tons/year | MD-850 or used equipment | Lower volume supports capital conservation; entry-level precision adequate |

| 50-150 tons/year | MD-1350 | Sweet spot for setup efficiency and throughput balance |

| 150-300 tons/year | MD-1350 or MD-2200 depending on width needs | Consider dual-line strategy or heavy-duty single line |

| 300+ tons/year | MD-2200 or multiple lines | High-volume justifies heavy-duty capacity and automation |

Similarly, evaluate your typical width range. If 80% of your processing fits within 600mm width, the MD-850 might eliminate expensive over-capacity. If you regularly process materials exceeding 1000mm width, the MD-1350 becomes essential rather than optional.

Light Gauge vs. Heavy Gauge: Capacity & Cost Trade-offs

Equipment designed for light-gauge materials (under 3mm thickness) differs substantially from heavy-gauge systems:

Light Gauge Equipment:

- Reduced cutting forces require lighter blade pressure

- More sensitive to material tension variations

- Faster speeds possible (300-400 m/min common)

- Lower capital cost

- Ideal for: foils, specialty alloys, precision laminations

- Examples: Custom MaxDo light gauge solutions, specialty configurations

Heavy Gauge Equipment:

- Robust design handles high cutting forces

- More tolerance for tension variations

- Slightly slower speeds (200-250 m/min typical)

- Higher capital investment

- Ideal for: structural steel, automotive grades, high-strength materials

- Examples: MD-1350, MD-2200 standard configurations

The choice between light and heavy gauge equipment should match your primary product focus. Attempting to force light-gauge processing on heavy-gauge equipment results in over-consumption of resources; forcing heavy-gauge materials through light-gauge equipment generates quality problems and accelerated wear.

Supplier Selection: Evaluating Coil Processing Equipment Manufacturers

When evaluating coil processing equipment manufacturers, move beyond price comparison:

Certification & Compliance:

- ISO 9001 quality management (standard for professional equipment)

- Regional safety certifications (CE marking for Europe, compliance with local standards)

- Material testing certifications for food-contact or aerospace applications

R&D Capability & Experience:

- Years in business (10+ years demonstrates stability)

- Number of installations (500+ indicates proven technology)

- Geographic reach (30+ countries suggests global support capability)

- Material yield performance (96%+ is professional standard)

Installation Track Record:

- Reference customers in your industry

- Site visit opportunities to see equipment in operation

- Case studies with quantified results

- Local installation support (not outsourced to third parties)

After-Sales Support:

- Service network coverage (particularly important if you operate globally)

- Spare parts availability and response time

- Technical support availability (phone, email, on-site)

- Training program quality

- Preventive maintenance program structure

Customization Flexibility:

- Ability to adapt standard equipment to your specific requirements

- Custom light gauge slitting machine options if needed

- Integration with existing production systems

- Retrofit capability for equipment upgrades

MaxDo demonstrates strength across all these dimensions: ISO 9001 certification, 20+ years R&D experience, 500+ global installations, 96%+ yield performance, established service network in 30+ countries, and proven customization capabilities. This multi-dimensional strength provides confidence that equipment investment will deliver long-term value.

Case Studies: Quantified ROI from MaxDo Slitting Line Installations

Real-world equipment performance provides more valuable guidance than specifications alone. These representative case studies demonstrate how MaxDo slitting line equipment delivers measurable results.

Automotive Parts Manufacturer: Setup Time & Waste Reduction

Scenario: Mid-sized automotive supplier processing 100 tons/month across 12 different steel grades for component manufacturers. Primary challenge: frequent material changes required 35-45 minutes setup time, generating scrap and reducing effective capacity.

Solution: MD-1350 installation with CNC-controlled blade positioning and servo tension control.

Implementation: Three-week installation, two-day operator training, integration with existing material handling system.

Quantified Results:

- Setup time reduced from 45 minutes to 12 minutes (73% reduction)

- Material waste during setup decreased from 2.5% to 0.4% (70% reduction)

- First-piece accuracy improved to 99.1% (from 96.8%)

- Throughput capacity increased from 100 to 128 tons/month (28% increase)

- Annual labor savings: $85,000 (0.75 FTE elimination)

- Annual material savings: $45,000 (from 2.1% waste reduction)

- Equipment investment: $520,000

- Payback period: 2.9 years

- 5-year ROI: 145%

The most significant benefit exceeded the quantifiable financial returns: the ability to accept new customer orders previously rejected due to capacity constraints, opening $400,000+ in annual revenue opportunity.

Steel Service Center: Throughput & Labor Optimization

Scenario: Regional steel service center operating two manual slitting lines built in the 1990s, processing 300 tons/month across 200+ customer SKUs. Equipment limitations: 40-minute setup times, ±0.4mm tolerance inconsistency, frequent blade change requirements (2-3 times/day).

Solution: MD-2200 replacement, supplementing rather than replacing the existing manual line.

Implementation: Site preparation (4 weeks), equipment delivery and installation (3 weeks), operator training (5 days), parallel operation and optimization (4 weeks).

Quantified Results:

- MD-2200 processed 220 tons/month (increased facility capacity from 300 to 520 tons/month)

- Setup time per job: 8 minutes (vs. 40 minutes on manual equipment)

- Blade life extension: 4x longer than manual system due to servo precision

- Quality consistency: ±0.1mm tolerance maintained across runs

- Labor requirements: One operator for two-shift operation (vs. three operators previously required)

- Annual labor savings: $220,000 (2.3 FTE reduction across shifts)

- Annual material savings: $165,000 (from 3.2% waste reduction on higher volume)

- Annual maintenance savings: $35,000 (from reduced blade changes and preventive maintenance scheduling)

- Unplanned downtime reduction: 55% (from predictive maintenance monitoring)

- Equipment investment: $1,450,000

- Payback period: 3.1 years

- 5-year ROI: 132%

Beyond the financial metrics, the equipment upgrade positioned the service center to compete for larger orders previously directed to larger competitors, establishing platform for market share growth.

Appliance Manufacturer: Quality Improvement & Cost Reduction

Scenario: Mid-volume appliance manufacturer requiring light-gauge steel processing (0.5-2mm) for component manufacturing. Quality challenges: edge burr complaints (12 complaints/month requiring customer rework), high first-piece scrap rate (3.2%), operator setup skill dependency.

Solution: MD-850 with custom light gauge slitting machine configuration.

Implementation: Specialized equipment commissioning (2 weeks), application-specific training (1 week).

Quantified Results:

- Edge quality complaints: Reduced from 12/month to 1.2/month (90% reduction)

- First-piece accuracy: Improved to 99.2% (from 96.8%)

- Setup scrap reduction: 94% elimination of setup waste

- Operator training time: Reduced by 60% due to automated setup

- Annual quality-related cost reduction: $52,000 (from eliminated rework and returns)

- Annual labor savings: $38,000 (reduced setup labor)

- Equipment investment: $380,000

- Payback period: 5.2 years

- 5-year ROI: 47%

While the payback period extended slightly due to lower throughput requirements, the quality improvement opened new customer relationships valuing precision, enabling premium pricing on specialty grades (+8% margin improvement on specialty products).

Success Factors: Maximizing Equipment Performance

Cross-case analysis reveals consistent success factors:

- Proper Capacity Sizing: Selecting equipment neither under-capacity nor dramatically over-capacity. MD-850 for 40 tons/month operations, MD-1350 for 100 tons/month, MD-2200 for 250+ tons/month.

- Operator Training Investment: Two-day commissioning training plus ongoing monthly skill development. Operators trained on predictive maintenance indicators (vibration, pressure, force monitoring) perform better.

- Preventive Maintenance Protocols: Following MaxDo’s maintenance schedule consistently (weekly blade inspections, monthly full system checks, quarterly deep maintenance) prevents 80%+ of unexpected failures.

- Existing Workflow Integration: Equipment success depends on seamless material flow from upstream coil handling to downstream processing. Partial integrations reduce efficiency benefits by 30-40%.

- Performance Monitoring: Implementing dashboards tracking setup time, material waste, throughput, and downtime identifies optimization opportunities within the first 90 days.

Implementation & After-Sales Support: MaxDo’s Turnkey Solution Approach

Equipment selection represents only 40% of successful implementation. The remaining 60% depends on professional installation, thorough training, and reliable long-term support—areas where many equipment suppliers fall short.

Turnkey Installation: From Site Assessment to Production

MaxDo’s implementation process follows structured methodology:

Phase 1: Site Assessment (2-3 weeks before delivery)

- Comprehensive evaluation of site infrastructure (electrical capacity, floor space, drainage)

- Existing equipment assessment (if upgrading from manual systems)

- Material handling system review (upstream decoiler, downstream packaging)

- Safety compliance verification

- Recommendations for infrastructure modifications

Phase 2: Installation & Commissioning (3-4 weeks)

- Equipment delivery and foundation preparation

- Mechanical installation and alignment

- Electrical system setup and testing

- Control system programming and calibration

- Safety system testing and documentation

- First production run and initial troubleshooting

Phase 3: Operator Training (2-5 days)

- Hands-on operation training (all operator roles)

- Maintenance protocol training

- Troubleshooting and problem-solving

- Documentation and reference manual review

- Competency verification testing

Phase 4: Performance Validation (2-4 weeks)

- Production runs across typical material range

- Performance verification against specifications

- Optimization of tension control and blade positioning

- Quality monitoring system setup

- Handoff to normal operations

Global Service Network & Technical Support

MaxDo maintains service capability across 30+ countries, ensuring equipment support wherever you operate. Service commitments include:

Technical Support:

- Phone support during business hours (email support 24/7)

- Remote diagnostics using equipment connectivity

- Response time: Technical acknowledgment within 4 hours, solution recommendations within 8 hours

- Escalation to on-site service if required

Spare Parts Availability:

- Standard spare parts in stock (blades, seals, bearings, sensors)

- Blade turrets within 2-3 days (express options available)

- Strategic spare parts program for extended operational life

Preventive Maintenance:

- Quarterly maintenance program (optional subscription)

- Condition monitoring and predictive maintenance alerts

- Annual performance review and optimization recommendations

- Equipment upgrade pathways for evolving production requirements

Warranty & Support Terms:

- Equipment warranty: 12 months from commissioning

- Electrical/control system warranty: 24 months

- Mechanical components: 12 months

- Blade warranty: Prorated based on material hardness and processing conditions

- Optional extended warranty programs available

*

Conclusion: Making the Equipment Selection Decision

Metal slitting lines vs. CTL systems represent fundamentally different processing solutions—the application scenarios differ, equipment capabilities differ, and the downstream processing workflows differ. Correctly matching your production requirements to the appropriate technology prevents expensive equipment mismatches.

Modern automation—servo tension control, CNC positioning, and predictive maintenance—delivers measurable ROI through reduced labor costs, improved material utilization, and extended equipment life. The 24-42 month payback periods documented in case studies reflect typical manufacturing operations. Higher-volume operations see faster payback; lower-volume operations extend the period but still achieve justified returns.

MaxDo’s MD series metal slitting line equipment provides scalable capacity options matching diverse production requirements:

- MD-850: Job shops and entry-level precision (20-820mm width)

- MD-1350: Service centers and mid-volume producers (20-1,300mm width, 1350mm slitting line standard)

- MD-2200: Large service centers and heavy fabricators (20-2,150mm width)

Equipment selection should never focus on initial cost alone. Comprehensive evaluation of labor requirements, material utilization improvements, automation capabilities, energy efficiency, and maintenance demands reveals true cost of ownership. The equipment delivering lowest payback period often carries higher initial investment but recovers capital faster through operational efficiency.

MaxDo’s 20+ years of R&D experience, ISO 9001 certification, 500+ global installations, and proven 96%+ material yield performance across diverse materials and production requirements provide confidence that equipment investment will deliver documented value.

Next Steps:

- Evaluate Your Requirements: Document annual processing volume, typical width range, material types, and automation priorities.

- Request Customized ROI Analysis: MaxDo’s engineering team provides site-specific ROI calculations accounting for your material mix, labor costs, and production volume.

- Schedule Equipment Demonstration: See metal slitting line equipment in operation processing your actual materials. Reference customer visits provide valuable practical perspective.

- Discuss Customization Options: If standard MD configurations require adaptation for light gauge processing, custom material handling, or special material support, MaxDo’s customization capabilities address specific requirements.

Contact MaxDo’s Equipment Specialists: Request a consultation to discuss your specific metal slitting line requirements, request customized ROI analysis, or schedule a facility tour to see precision metal slitting equipment in operation.